Main meals

- Canary Capital was introduced to SEC to launch ETF CRO.

- The proposed fund aims to provide investors with CRONOS (CRO), the original symbol of the CRONOS Blockchain.

Share this article

The CANARY CAPITAL Director presented S-1 model Registration statement With the start of the SEC Canary Staped CRO ETF, a new investment product aims to track the instant price of Cronos (CRO) with additional CRO with Staking.

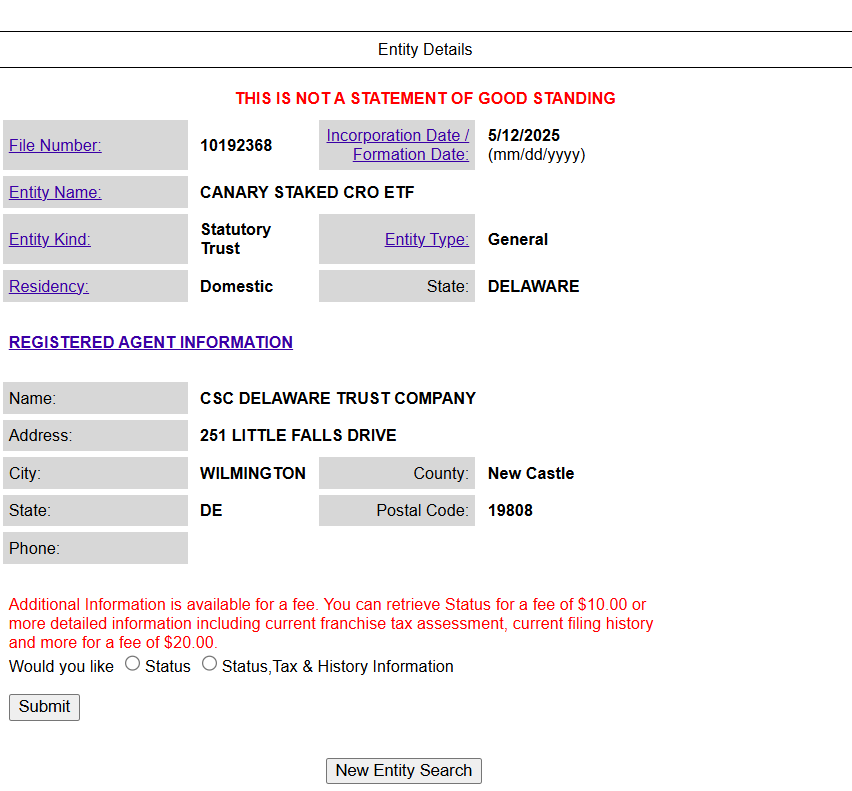

The official SEC file follows the CANARY CAPITAL registration for the TRST entity in the state of Delaware earlier this month, a step that usually indicates an imminent official presentation to SEC.

The CRO will be held by Trust by Foris Dax Trust Company, as it performs business such as Crypto.com Custody Trust, while all evaluation activities will be carried out through approved infrastructure service providers, as mentioned in the deposit. Any amazing CRO will undergo a non -mandatory period for 28 days during which it cannot be transferred or pulled.

The company will impose uniform annual fees, although the percentage is still unannounced. The box index code is currently not available.

“The investment funds circulated in the traded investment funds were an effective way to expand investors’ participation in encryption and increase the integration of digital and traditional financial capabilities,” Eric Anziani, President and Director of Operations at Crypto.com said on Friday. statement. “We are very excited to see this important step that is taken in construction towards all investors in the United States have the opportunity to interact with CRO through investment funds circulating with Canary Capital.”

Cronos Etf’s launch is part of Crypto.com Strategy To expand its platforms in 2025, which also includes plans to present Stablecoin. This exchange targets both investors from retail and institutions, which reflects the growing prevailing acceptance of the encrypted surveys, especially in the United States.

Last month, Crypto.com and Trump Media & Technology Group have announced a partnership to launch the Investment Funds in America First -related to digital assets such as Bitcoin and Cronos, with Foris Capital US responsible for the distribution of funds.

If approved, the suggested Canary Capital fund will become the first Cronos ETF site in the United States.

In addition to the proposed Cranos ETF, the CANARY CAPITAL follows SEC’s approval of many investment funds traded in Canary Crypto, including Canary Staled TRX ETF, which tracks the price of Tron, and Sei Sei Etf, which provides direct exposure to SEI symbols from the SEI network.

On Thursday, SEC staff issued a statement that most of the activities of Crypto Staking on the evidence groups do not fall under US Securities Laws.

The guidelines set exciting rewards as compensation for the services provided by Al -Aqda operators instead of profits from entrepreneurs, and it is reported that urban and additional services related to roaming are not securities offers.

Share this article