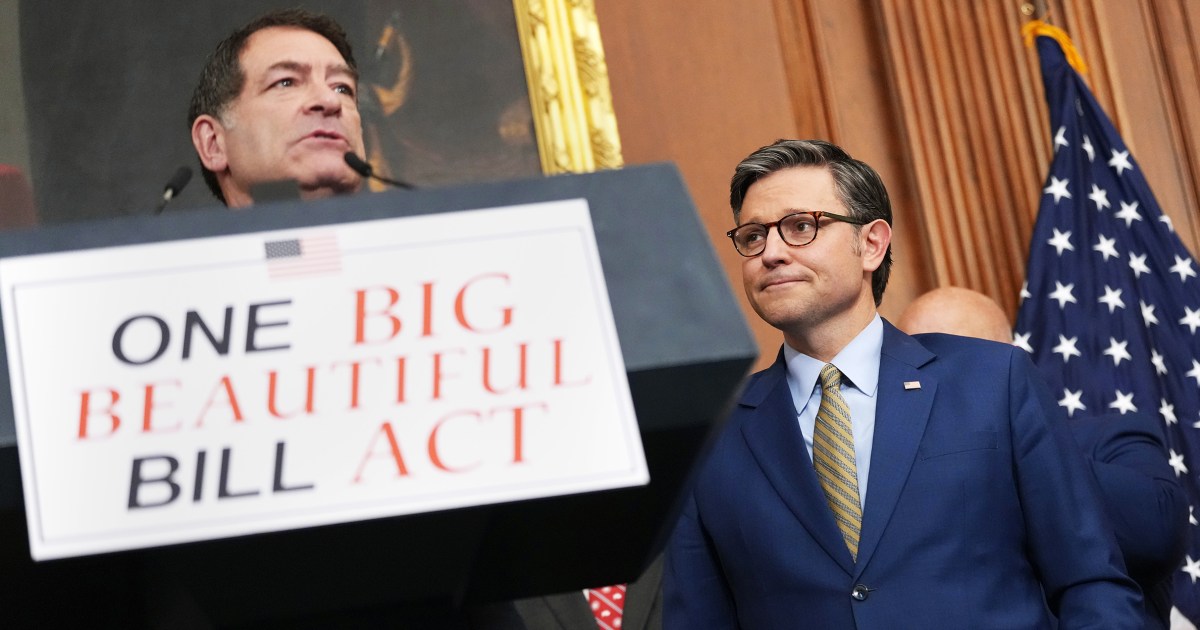

WASHINGTON – The huge local policy bill approved by Republicans in the House of Representatives on Thursday with one vote that would reshape the federal budget to trillion dollars, affecting millions of Americans.

President Donald Trump’s agenda legislation was supported by almost every Republic in the House of Representatives and opposed to the unanimous Democrats who were cut off from negotiations. He is now heading to the Senate led by the Republican Party, where it is likely to change before it reaches the Trump office.

Here are the main provisions in the sprawling package.

Trump’s tax cuts, with some modifications

The axis of the bill is an extension of Trump tax discounts for the year 2017, which will end at the end of this year. This means that the current low prices, expanded standard discount, business tax exemptions, and many other provisions will continue. This step affects Americans in all income tax brackets, but the largest benefits are expected to go to the highest owners.

Legislation also indicates an important change in local and state tax discount – known as Salt – by enhancing the current maximum of $ 10,000 to $ 40,000. The discount only applies to taxpayers who earn less than $ 500,000 a year.

The draft law maintains a bunch of interest tax that has been carried, although the White House says Trump wants to end it.

There is no tax on advice or additional work

The bill also seeks to fulfill the promises of the Trump campaign: exempting advice and paying additional work from federal income taxes.

Ending taxes on the profits achieved by workers from tips will cost $ 40 billion. This policy applies to cash advice in professions that “usually received and usual tips” as of the end of 2024, as it is approved by the administration. But experts questioned the expansion of the effect, given that many distinguished workers do not gain enough to pay federal income taxes to start.

It also stops taxes on the additional work wages at a cost of $ 124 billion, according to the Non -party Congress budget office.

The package also includes a tax break for automatic loan benefits. It calls for temporarily increasing child tax credit to $ 2,500 and enhancing tax discounts for the elderly.

All of these tax exemptions will continue at the end of 2028.

Medicaid discounts and new requirements

The legislation contains one of the largest discounts in Medicaid financing in modern history, which is expected to reach about $ 700 billion by the Central Bank of Oman.

This includes strict work requirements for adults who are less than 65 years old, which will start on the last day of 2026, creating new rules and papers for those in Medicaid. It also adds eligibility checks frequently, addressing challenges and rulings to verify the legal status of beneficiaries.

The draft law also reduces medicaid financing for the states if they allow people in the United States illegally to reach Medicaid.

The financing increases to Ten countries Almost all of them dominate the Republicans – who refused to expand the Medicaid scope under reasonable prices, as an incentive for them to continue rejecting the additional program.

In general, the legislation is expected to eliminate health coverage of 8.6 million people, according to CBO, although the number may change given that the revised bill leads to some changes earlier.

Discounts to pick up

The package strikes a program in another federal safety federal: food stamps. To achieve savings, the legislation reduces $ 290 billion of supplementary nutritional aid program, or the food aid program for low -income Americans.

It includes tougher work requirements for Snap participants. Currently, a capable physical adults under the age of 55, without children, can have limited advantages unless they show that they comply with work requirements. But the ruling on the draft law expands these work requirements to adults who are under the age of 65.

Returning from clean energy funds and tax credit

The bill ends several hundred billion dollars in clean discounts. It ends the energy tax exemptions for consumers, including clean vehicles and energy -saving elements for homes. Ends or stages of production credits or investment tax for clean fuel, clean electricity and hydrogen production.

Cash pumping to enforce immigration

The draft law contains about $ 150 billion of new funds to enhance border security and implement Trump’s mass deportation plans. This includes money to end the construction of the barrier system on the borders of the United States and Mexico, increase funding for customs and protect the American border.

There are also new fees and increased costs for potential migrants to apply for a legal status.

A big boost in military spending

The legislation includes one batch of $ 150 billion in new military spending on issues such as shipbuilding, air defense and missile, nuclear forces and cybersecurity, among other things.

Trump accounts

The measure creates a new Preparation of tax savings For children, federal government seeds with a deposit of $ 1,000. Parents can then contribute an additional amount of $ 5,000 annually until the child is 18 years old. Money can be used for educational purposes, to get a batch offered to the house or to start a small company.

The original version of the Republican legislation in the House of Representatives described them as “Maga” accounts, but after the eleventh hour modified, Trump’s accounts were renamed.

The height of the debt

The CBO is expected to add 2.3 trillion dollars to the federal deficit over 10 years, with tax exemptions and new expenses outperform savings.

It also raises the roof of the debt by $ 4 trillion before the final date in the summer announced by the Congress Treasury to act or risk a catastrophic negligence. Treasury Secretary Scott Beesente urged Congress to act by mid -July to prevent economic collapse if the US government is unable to meet its obligations.