Main meals

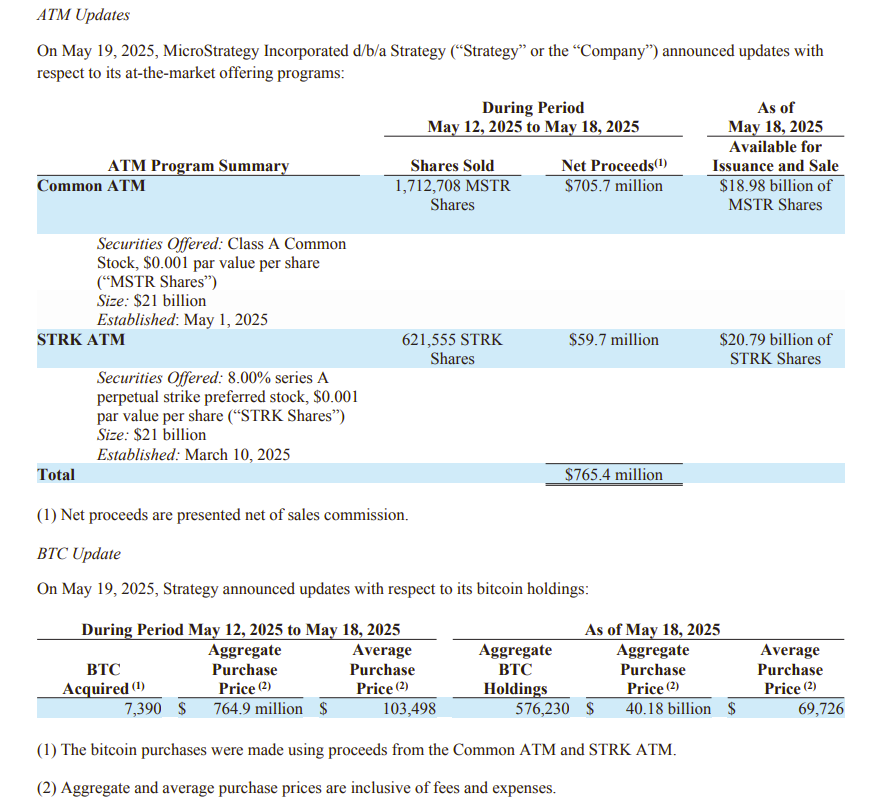

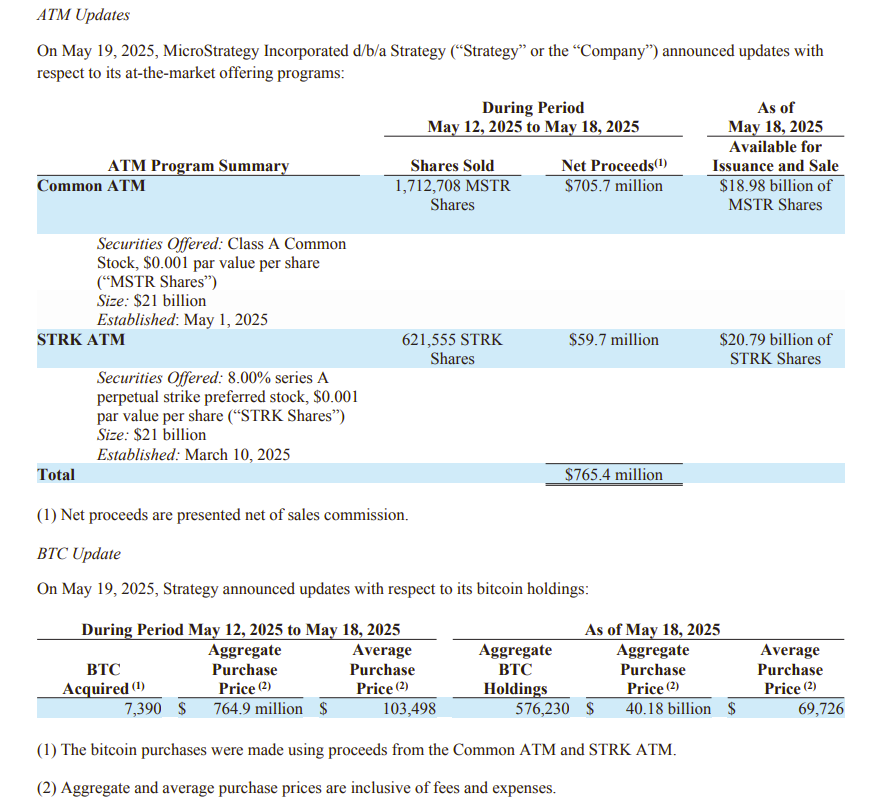

- The strategy bought 7,390 Bitcoin for $ 555 million at an average price of $ 103,498.

- The company aims to maintain $ 42 billion in Bitcoin by 2027, and accumulate 576,230 BTC so far.

Share this article

Michael Celor’s strategy revealed on Monday that it bought 7390 Bitcoin between 12 and 18 May, investing about 765 million dollars in the acquisition. With this step, the company strengthened Bitcoin’s possessions to 576,230 BTC, which exceeds more than $ 59 billion.

The software company funded the latest Bitcoin acquisition through the capital, which was raised from its joint shares and the issuance of a favorite, transferred, transferred shares from the series A, according to Monday presentation With a second. During the previous week, the strategy sold about 1.7 million MSTR shares and 621,555 STRK shares, generating about $ 765 million of net returns.

The company still owns more than $ 18.9 billion of MSTR shares and about $ 20.7 billion of StRK shares that are still approved for the release and sale in the future. It aims to collect $ 42 billion in Bitcoin by the end of 2027, regardless of market conditions.

As the largest company holder in Bitcoin, the strategy now controls more than 2.7 % of the total BTC supplies, followed by Mara Holdings and Twenty Twenty, the newly created original company.

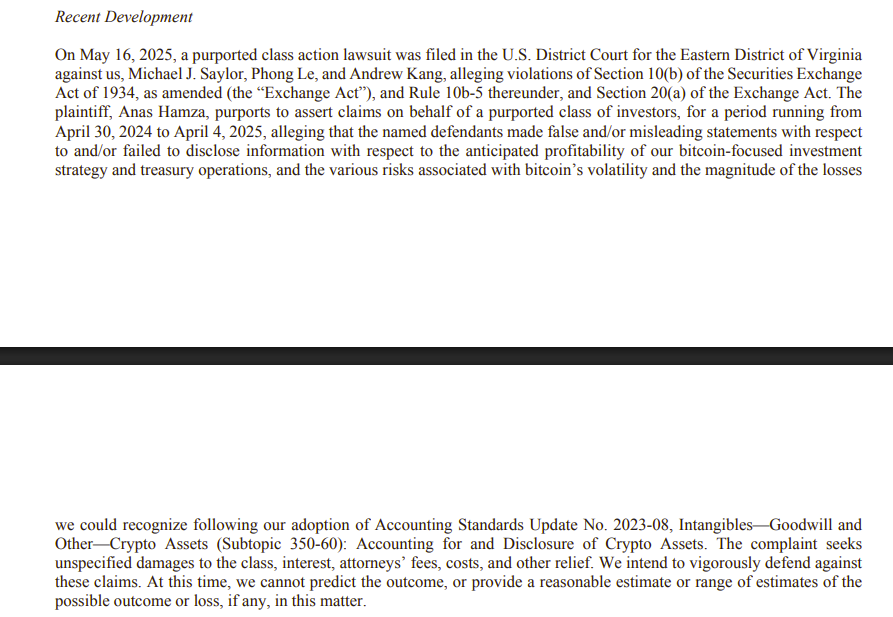

In the disclosure of SEC today, the strategy also said it is facing a collective lawsuit filed on May 16, 2025, in the American Provincial Court of the Eastern Region in Virginia.

The lawsuit claims that the strategy and its executives made misleading statements and failed to reveal the risks related to its strategy in Bitcoin and new encryption accounting rules.

The company said that it will fight the lawsuit, but it noted that it is unable to predict the result or determine the possible losses at the present time.

Share this article